CA SI-550 NC 2020-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

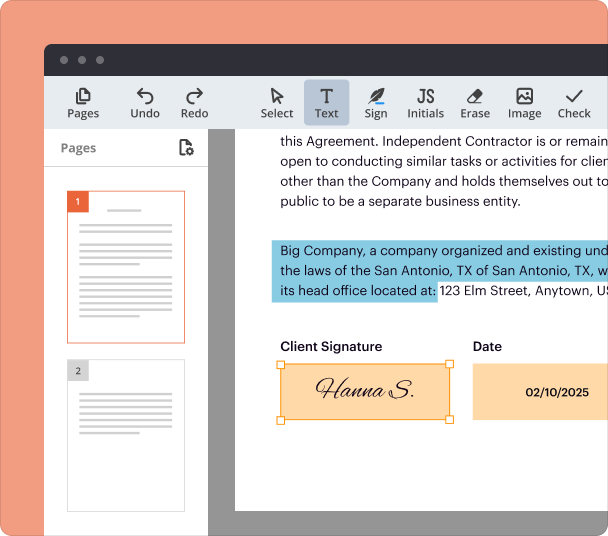

Edit and sign in one place

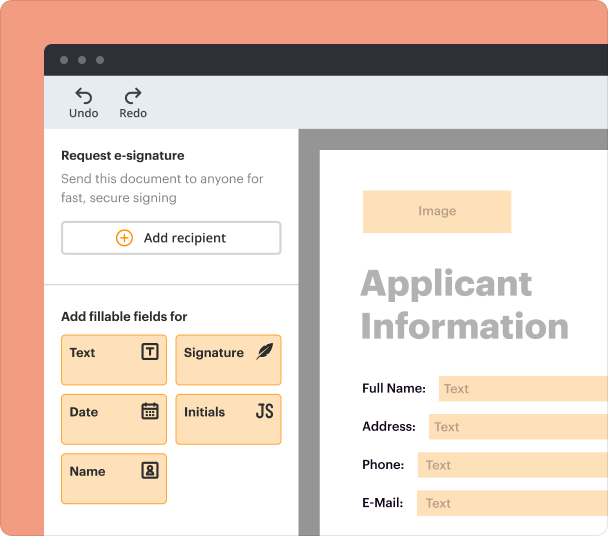

Create professional forms

Simplify data collection

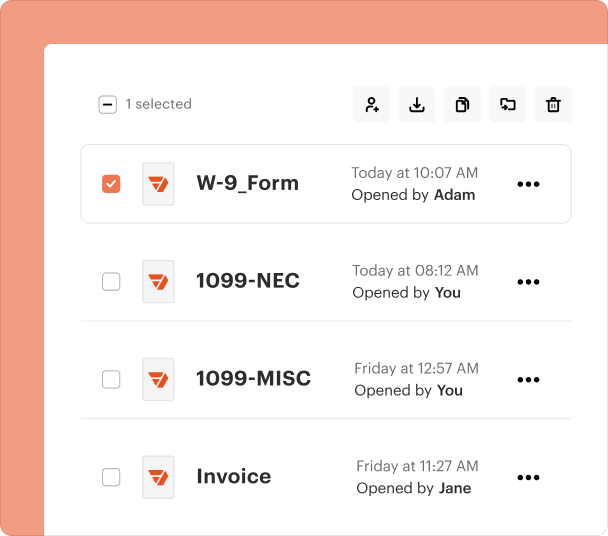

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Essential Information about the CA SI-550 NC Form

Overview of the CA SI-550 NC Form

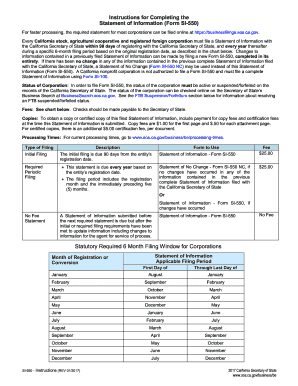

The CA SI-550 NC form is a vital document used by California stock agricultural cooperatives and registered foreign corporations. This form allows these entities to indicate that there have been no changes in their information since their last complete Statement of Information filing. It streamlines the process for corporations to maintain their compliance with state regulations.

Who Needs the CA SI-550 NC Form?

This form is necessary for active California stock agricultural cooperatives and registered foreign corporations that have already submitted a complete Statement of Information. Nonprofit corporations are not eligible to use this form and must submit a full Statement of Information.

Key Features of the CA SI-550 NC Form

The CA SI-550 NC form offers several key features that contribute to its utility: it confirms the absence of changes to previously submitted information, it simplifies annual reporting for eligible corporations, and it maintains compliance with the California Secretary of State’s requirements. Additionally, the form is designed for ease of completion, ensuring clear sections for necessary information.

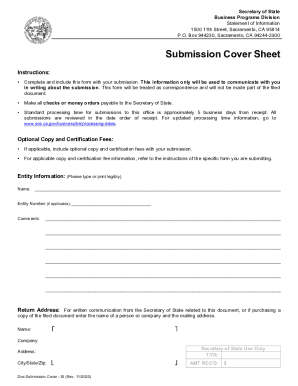

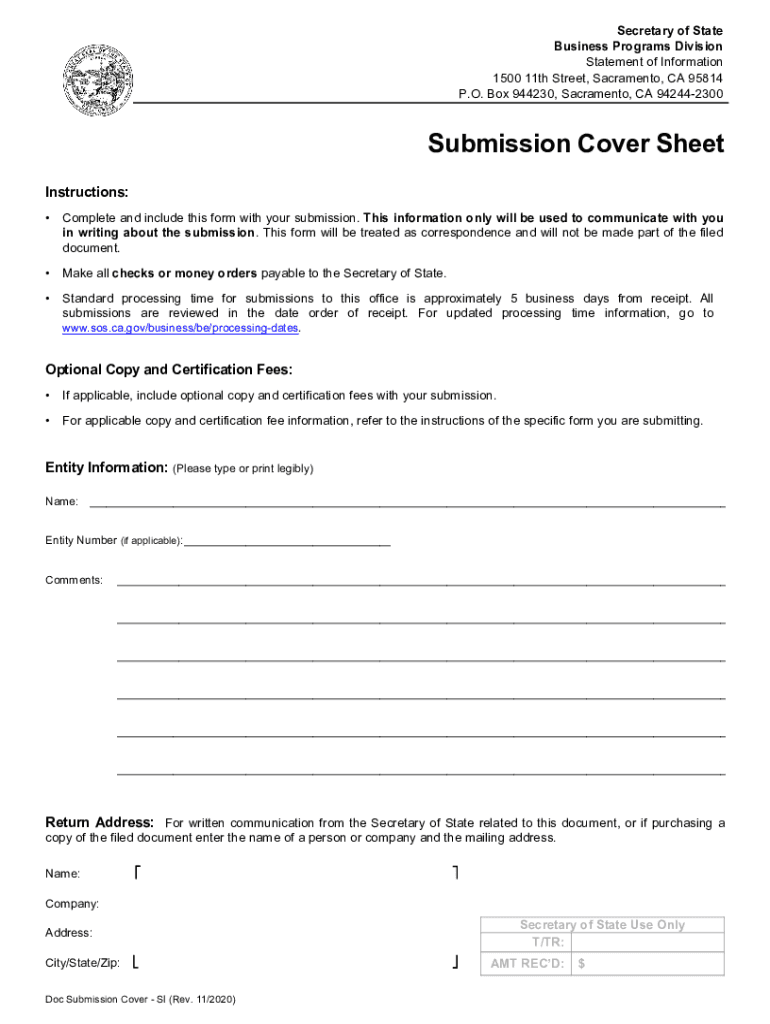

How to Fill the CA SI-550 NC Form

Completing the CA SI-550 NC form involves several important steps. First, ensure that your corporation's status is active or suspended forfeited according to the California Secretary of State's records. Next, fill in the entity details as previously submitted. It is crucial to review the information foraccuracy. Sign and date the form once completed, and retain a copy for your records.

Common Errors to Avoid

When completing the CA SI-550 NC form, it is important to avoid common pitfalls. Ensure all entity information matches your last filing exactly, as discrepancies can lead to processing delays. Double-check for missing signatures or dates, and verify that only eligible corporations submit this form. Awareness of these errors can help ensure smooth compliance.

Benefits of Using the CA SI-550 NC Form

Utilizing the CA SI-550 NC form offers significant benefits for corporations. It provides a straightforward method to confirm that no changes have occurred since the last filing, saving time and reducing administrative burdens. By keeping records updated without full resubmission of documents, corporations can maintain compliance efficiently and effectively.

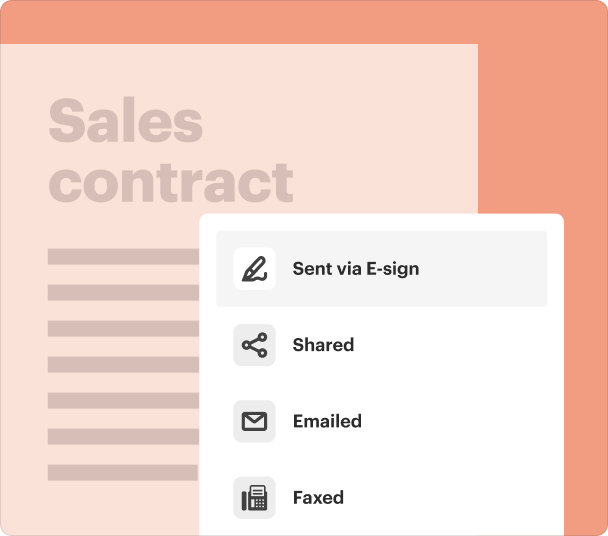

Submission Methods for the CA SI-550 NC Form

The CA SI-550 NC form can be submitted via mail to the California Secretary of State’s office. Ensure that the form is accompanied by the required fees and copies where necessary. It is also advisable to track submissions to confirm receipt, thus ensuring timely processing of your form.

Frequently Asked Questions about si 550 form

What is the purpose of the CA SI-550 NC form?

The purpose of the CA SI-550 NC form is to confirm that there have been no changes in the information submitted in the previous Statement of Information by eligible corporations, thereby simplifying their compliance process.

Can nonprofit corporations use the CA SI-550 NC form?

No, nonprofit corporations are not eligible to use the CA SI-550 NC form and must submit a complete Statement of Information.

What are the consequences of filing incorrect information on the CA SI-550 NC form?

Filing incorrect information can lead to processing delays, potential penalties, and compliance issues with state regulations.

pdfFiller scores top ratings on review platforms